Crypto’s Inevitable Crash

In their current state, cryptocurrencies are doomed to fail. This isn't an uncommon sentiment either, there are plenty of different crypto blogs that share this opinion. The crypto market is becoming more and more intertwined as well as getting more and more inflated. It’s looking to be a giant bubble that’s bound to pop, and pop soon.

One of the many reasons crypto is doomed is the prevalence of Tether throughout all the coins and its fraud.

For those of you who don’t know what Tether is, it is a cryptocurrency that is designed to facilitate the use of fiat currencies in a digital manner. Tether tries to achieve this by making the coins price always equivalent to $1. Coins that operate in this fashion call themselves “stablecoins” to show that it is less volatile than bitcoin where the price of a coin can fluctuate thousands of dollars every day. Tether also insures that their coin is backed by the reserves they own, although they use shady language in their FAQ when it comes to that. They say: “The Tether Platform is fully reserved when the sum of all Tether tokens in circulation is less than or equal to the value of our reserves.”

Tether has recently been in some hot water over their claims of these reserves. They announced that they had “just under $30bn in commercial paper, a short-dated investment similar to cash. Such holdings of companies' short-term debt would make it the seventh-largest in the world.” However, this was news to Wall Street as most of the big players hadn’t heard of them, let alone trade with them. Which begs the question, how did they come to be the 7th largest holder of commercial paper with no one trading with them?

The future of Tether is not looking bright as well. Treasury secretary Janet Yellen “urged agency heads at the July 19 meeting to “act quickly” to ensure stablecoins face appropriate rules.” Furthermore, Tether is starting to be investigated by the Department of Justice for bank fraud. More specifically whether or not the executive of Tether concealed from lenders that transactions were linked to crypto. Federal investigations never bode well for any company, and the damage in public perception can be fatal.

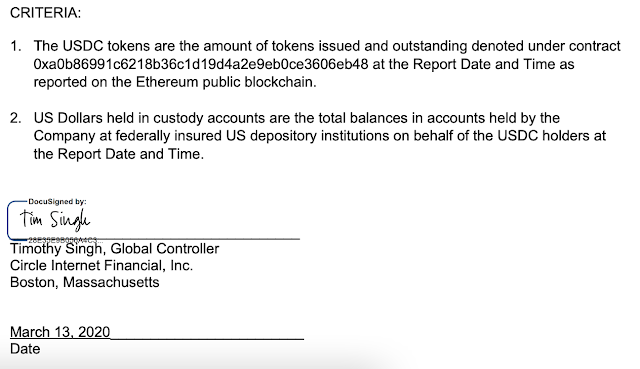

Another reason that crypto is in trouble is due to another stablecoin, Circle USDC, who says they are transparent but their actions say otherwise. Like Tether, USDC is a stablecoin that is supposed to be backed by actual US dollars. Initially, the reserve of USD Circle USDC had was just money in federally insured US depository institutions.

|

| USDC |

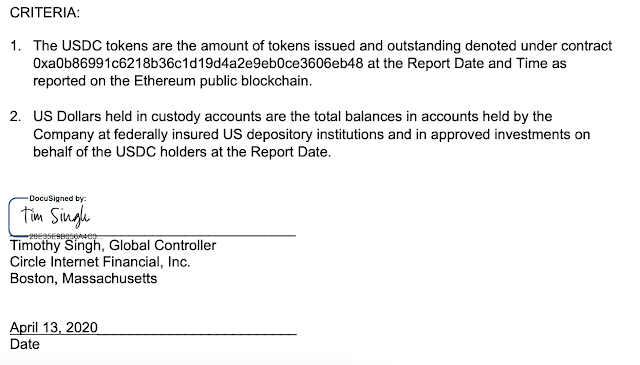

However, after Bitcoins price fell ~50% amid the coronavirus panic, they amended their reserve account report they count the money that's been put into "approved investments" as money in reserve.

|

| USDC Update |

Circle USDC is a brand that was supposed to be built on transparency and trust, but the evasiveness of Circle with their approved investments is cause for worry.

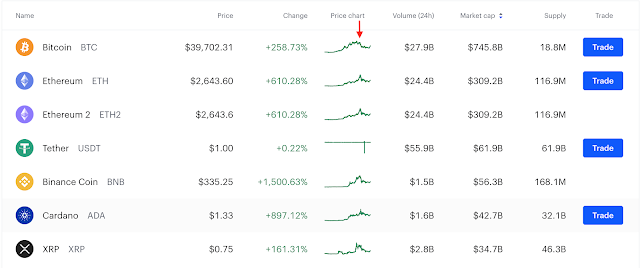

Now's the time to ask the big question: How does this affect the rest of the cryptocurrency market? One study shows how there are people who are artificially boosting Bitcoin's price with Tether. They state:

|

| Coin Market Cap |

Many crypto blogs are getting nervous about an upcoming crash and it’s this crypto blogs opinion that you should be as well.

Comments

Post a Comment